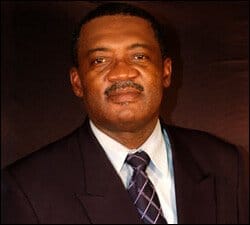

Eugene Hamilton – British American Insurance

Basseterre, St. Kitts – Nevis

September 03, 2009 (CUOPM)

General Manager of British American Insurance Company Limited in St. Kitts, Mr. Eugene Hamilton has been requested to refrain from effecting any policy either generally or with respect to a specified class whether or not the effecting of policy falls within a class of insurance business which the registered company is authorized to carry on.

Mr. Hamilton was one of three Directors of British American, who wrote to the Prime Minister of St. Vincent and the Grenadines, Dr. the Hon. Ralph Gonsalves in June informing him of the dire financial position of British American.

According to the Official Gazette, notice of intervention was communicated in a letter to Mr. Hamilton by St. Kitts and Nevis Minister of Finance, Dr. the Hon. Timothy Harris, who requested Mr. Hamilton to give full cooperation and assistance to the Registrar of Insurance and her team as they seek to ascertain and verify the information provided by his company.

“In said letter, the Board of Directors, of which you are a member, has stated that, “BAICO’S demise is now days away and powerless to prevent the Group’s imminent collapse”¦In the face of our inability to delay the inevitable, we must now discharge our final responsibility and stand aside to allow the regulators with jurisdiction over BAICO to intervene in the public good. Therefore intervention was requested by the Board of Directors of BAICO,” said Registrar of Insurance, Ms. Kerstin J. Petty in a separate letter to Mr. Hamilton.

“In light of the grave assertions and request made by the Board of Director of BAICO, the Registrar of Insurance must intervene in accordance with section 57 of the Insurance Act, No.8 of 2009,” she informed Mr. Hamilton.

The Registrar of Insurance also informed Mr. Hamilton that he is to refrain from making investments of a specified class or description in real estate or any other investment whatsoever.

Mr. Hamilton was also informed by the Registrar that she intends to have an actuary or any other person appointed to investigate the financial position of the registered insurance company in respect of its insurance business or any part of the business and to submit to the Registrar a report of the investigation.

He is also required to take any action that appears to the Registrar to be necessary to protect policyholders or potential policyholders of the registered company against the risk of the registered insurance company’s inability to meet its liabilities; avoid further exacerbating the risk of the company being unable to meet its liabilities; avoid further jeopardizing the reasonable expectations of policyholders or potential policyholders; and generally grant access to company files and documents and to allow the Registrar or anyone appointed by the Registrar to take such action during the intervention as appears to him necessary to ensure the proper administration of the Act.

Mr. Hamilton is also required to cease or refrain from committing an act or pursuing a course of conduct that is unsafe or unsound practice in conducting the business of the registered insurance company.

He was also informed that the cost of any exercise of the power of intervention by the Registrar shall be borne by the insurance company.