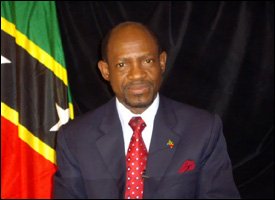

PM Douglas and The Labour Party Introduce Value Added Tax

Photo By Erasmus Williams

Basseterre, St. Kitts – Nevis

October 27, 2010 (SKNIS)

A member of the support staff to the Tax Reform Unit, Economist Gary Thomas says the team is eagerly poised for the November 1 implementation of VAT.

Mr. Thomas who is temporarily assigned to the Unit from the Ministry of Finance said it was important that people become fully aware of the benefits of the Value Added Tax (VAT) which has “built-in” safeguards against over taxation.

The VAT specialist explained that those businesses which pay more in input Vat, than they receive from Output VAT will be eligible for a refund. He elaborated that input VAT is the tax that a business pays to Inland Revenue whereas, output VAT is the amount of VAT the business charges on its goods and services.

He added that the difference between the two would determine whether the business is in a payable position or not.

Mr. Thomas emphasized the fact that the refunds would accumulate for a period of four months after which businesses would be required to fill out a refund form, which can be accessed at the Inland Revenue Department or downloaded from their website www.SKNVAT.com.

The economist said a very small subsector, including exporters in the manufacturing sector would be given consideration for refunds prior to the stipulated four month period, but this would be a very select group.

Mr. Thomas told SKNIS that the only distinction between “zero-rated” and “exempted” items was in relation to whether or not a business was eligible for a refund. “Businesses cannot claim refunds on any item that has been exempted due to expenses incurred as a result of providing that good. On the other hand, businesses are entitled to full refunds for any VAT paid that is incidental to the supply of goods or services on zero rated items.

For the average consumer however there is no distinction. You will pay no VAT on any item that is zero-rated or exempted,” Mr. Thomas emphatically concluded.